Salary tax withholding calculator

Get Your Quote Today with SurePayroll. Pay Your County Taxes Online.

How To Calculate Federal Income Tax

When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

. Unemployment insurance FUTA 6 of an employees first 7000 in wages 2022 2. Choose an estimated withholding amount that works for you. To estimate the impact of the TRAIN Law on your compensation income click here.

Certain additional regulations apply for employees who are resident in New York City. All Services Backed by Tax Guarantee. Ad Payroll So Easy You Can Set It Up Run It Yourself.

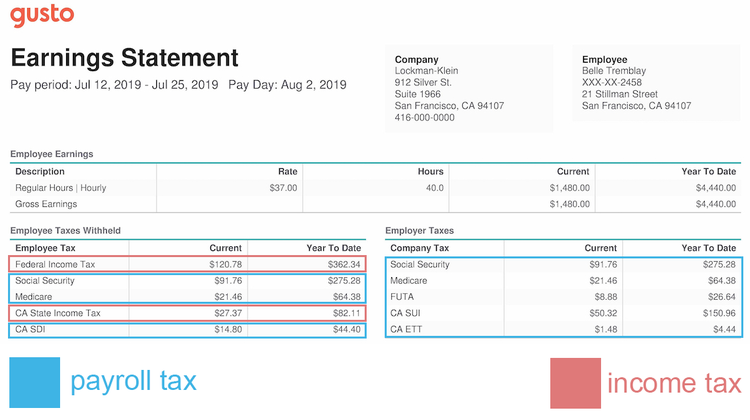

There have been slight changes to withholding calculations for the federal income tax as well as Form W-4. The tax usually shows up as a separate line on pay stubs. How It Works.

The Cumulative Average Method in computing withholding taxes where the total supplementary compensation is equal or greater than the total regular compensation cannot be accommodated in the calculator. The Tax withheld for individuals calculator is for payments made to employees and other workers including working holiday makers. Medicare 145 of an employees annual salary 1.

Businesses impacted by recent California fires may qualify for extensions tax relief and more. Earnings Withholding Calculator. If you are an employer as described in federal Publication 15 Circular E Employers Tax Guide and you maintain an office or transact business within New York State whether or not a paying agency is maintained within the state you must withhold personal income tax.

To access Withholding Tax Calculator click here. Get Started Today with 2 Months Free. Enter your info to see your take home pay.

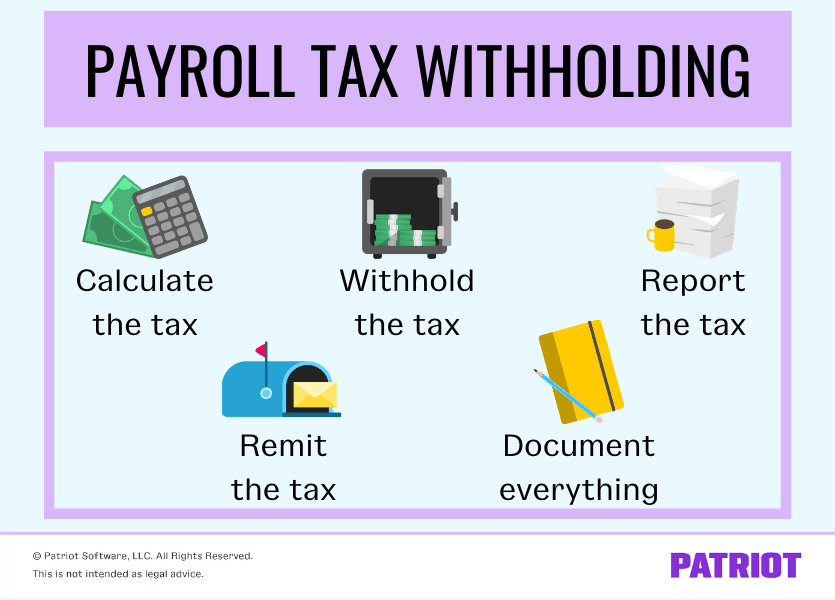

Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. It will take between 2 and 10 minutes to use. Refer to employee withholding certificates and current tax.

Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand how to maximize your tax refund or take-home pay. The Tax Withholding Estimator compares that estimate to your current tax withholding and can help you decide if you need to change your. You can use the Tax Withholding Estimator to estimate your 2020 income tax.

Paid to the Receiver in each town. The 2nd 3rd and 4th payments are paid to the Commissioner of Finance and may be paid via our online payment system. The information you give your employer on Form W4.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and other specialty payroll calculators for all your paycheck and payroll needs. Use this tool to. Tax withheld for individuals calculator.

1 COUNTY TOWN TAX. How Your Paycheck Works. Estimate your federal income tax withholding.

People trusts and estates must pay the New York City Personal Income Tax if they earn income in the City. For help with your withholding you may use the Tax Withholding Estimator. With no state or local income taxes you might have an easier time.

SmartAssets Washington paycheck calculator shows your hourly and salary income after federal state and local taxes. Choose the right calculator. If you have a saved online draft application or renewal please submit.

Ad Read reviews on the premier Paycheck Tools in the industry. Online Services updates are scheduled for Wednesday August 31. Federal Salary Paycheck Calculator.

How to calculate taxes taken out of a paycheck. Withholding tax requirements Who must withhold personal income tax. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000.

There are 3 withholding calculators you can use depending on your situation. Ad Build Your Future With a Firm that has 85 Years of Investment Experience. GetApp has the Tools you need to stay ahead of the competition.

Please visit our State of Emergency Tax Relief page for additional information. Could be decreased due to state unemployment payment. See how your refund take-home pay or tax due are affected by withholding amount.

Depending on the state where a business is located and where its employees live employers may be responsible for paying. IRS tax forms. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Whatever Your Investing Goals Are We Have the Tools to Get You Started. Free salary hourly and more paycheck calculators. Estimate your paycheck withholding with our free W-4 Withholding Calculator.

Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances claimed. Thats where our paycheck calculator comes in. The tax is collected by the New York State Department of Taxation and Finance DTF.

Switch to hourly calculator. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free federal paycheck calculator. Then make adjustments to your employer W-4 form if necessary to more closely match your 2022 federal tax liability.

Federal Income Tax Fit Payroll Tax Calculation Youtube

Payroll Tax What It Is How To Calculate It Bench Accounting

Pay Tax Calculator Store 60 Off Www Al Anon Be

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Withholding Tax A Simple Payroll Guide For Small Business

How To Calculate Payroll Taxes Methods Examples More

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

Social Security Tax Calculation Payroll Tax Withholdings Youtube

How To Calculate Income Tax In Excel

Tax Calculator For Wages Online 56 Off Www Ingeniovirtual Com

Payroll Tax Vs Income Tax What S The Difference

How To Calculate Federal Withholding Tax Youtube

Payroll Tax Calculator For Employers Gusto

How To Calculate Income Tax In Excel

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form